Fintech, short for financial technology, has revolutionized how we manage and access financial services. From online banking to mobile payments, fintech software is crucial in shaping the modern financial landscape. We will examine the evolution, essential elements, development method, and upcoming trends in Fintech Software Development in this extensive book.

Understanding Fintech

Defining Fintech

A wide range of technologies that seek to improve and automate the usage of financial services are together referred to as fintech. It leverages cutting-edge solutions to streamline processes, making financial transactions more efficient and accessible.

Evolution of Fintech

From the advent of ATMs to the rise of Mobile Banking Apps and Fintech App Development Company the fintech industry has experienced rapid evolution. Understanding this evolution provides valuable insights into fintech’s current state and future possibilities.

The Need for Fintech Software

Addressing Market Gaps

Fintech software emerges in response to identified gaps in the market, providing solutions that traditional financial institutions may overlook. This proactive approach allows fintech to cater to diverse financial needs.

Enhancing Financial Software Development Services

Fintech software development is primarily motivated by the ongoing endeavor to improve the caliber and availability of financial services. Fintech developments, such as robo-advisors and online lending platforms, are changing how we deal with money.

Cost of Developing a Hospital Management System in 2024

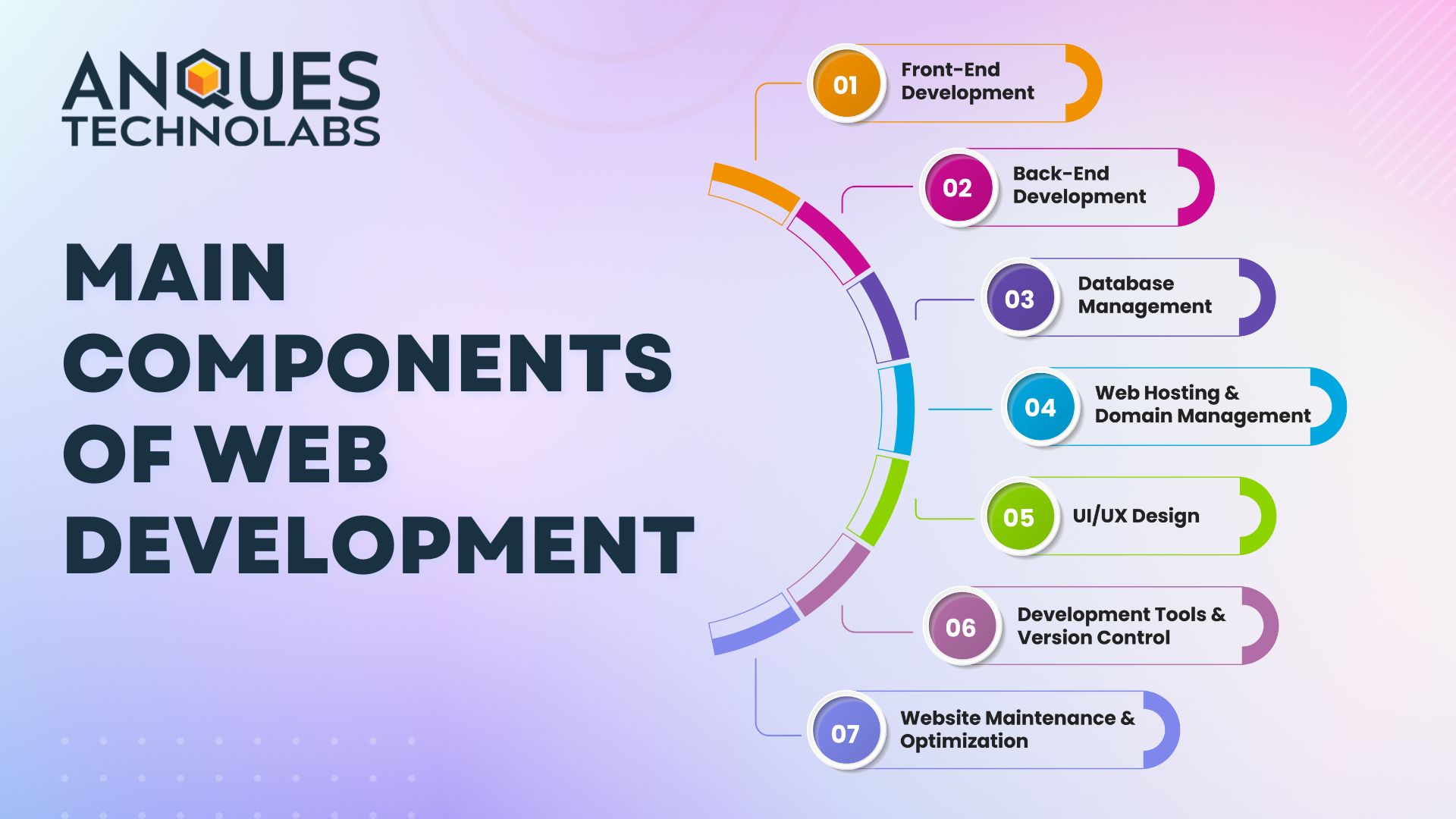

Key Components of Fintech Software

Security Infrastructure

Security is paramount in the financial sector. Fintech software must integrate robust security measures to safeguard user data, transactions, and overall system integrity.

User-Friendly Interface

A seamless user experience is crucial for the success of fintech applications. Intuitive interfaces and easy navigation contribute to user satisfaction and adoption.

Integration Capabilities

Fintech software often needs to integrate with various financial institutions, third-party services, and emerging technologies. Flexibility in integration is key to ensuring the software’s adaptability to evolving market demands.

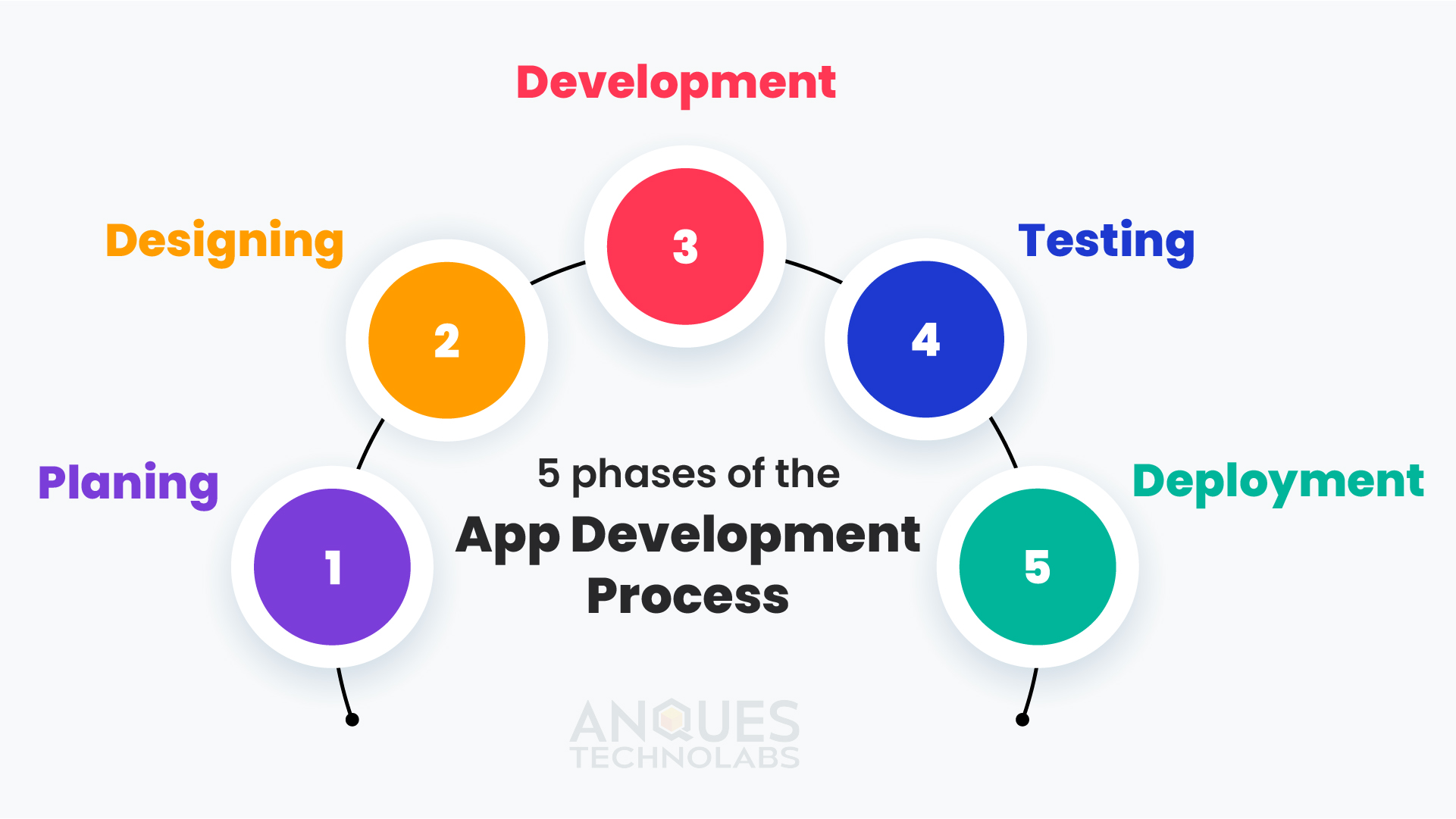

Steps in Fintech Software Development

Market Research

Before embarking on development, thorough market research is essential. Understanding user needs, competitor landscapes, and regulatory requirements lays the foundation for a successful FinTech software project.

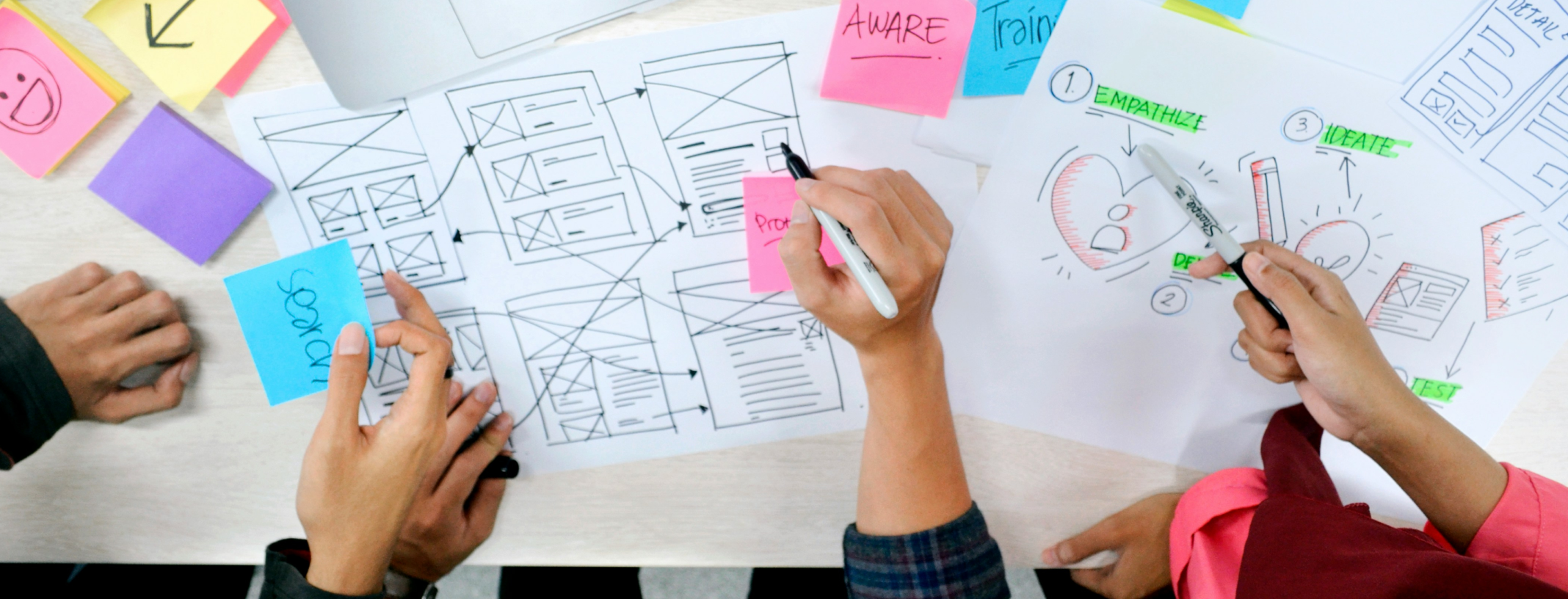

Planning and Strategy

Strategic planning involves defining project goals, timelines, and resource allocation. This stage sets the roadmap for the entire development process.

Design and Prototyping

User-centric design is crucial for fintech software. By gathering user feedback early in the process through prototyping, developers can make sure the end product lives up to consumer expectations.

Development

The actual coding phase involves turning the design into a functional software solution. Success requires cooperation between developers, designers, and other stakeholders.

Testing

Comprehensive testing is vital to identify and rectify any bugs or issues. Rigorous testing ensures a stable and secure Fintech Software Development.

Deployment

Launching the fintech software into the market requires careful planning and execution. Coordinated efforts ensure a smooth transition from development to real-world application.

Maintenance and Updates

Post-deployment, continuous maintenance, and updates are necessary to address any issues, enhance features, and adapt to evolving market trends.

Which is the Best Food Delivery Apps Developer Company

Technologies Driving Fintech Innovation

Blockchain

Blockchain technology provides a secure and transparent way to conduct financial transactions. Its decentralized nature eliminates the need for intermediaries, reducing costs and increasing efficiency.

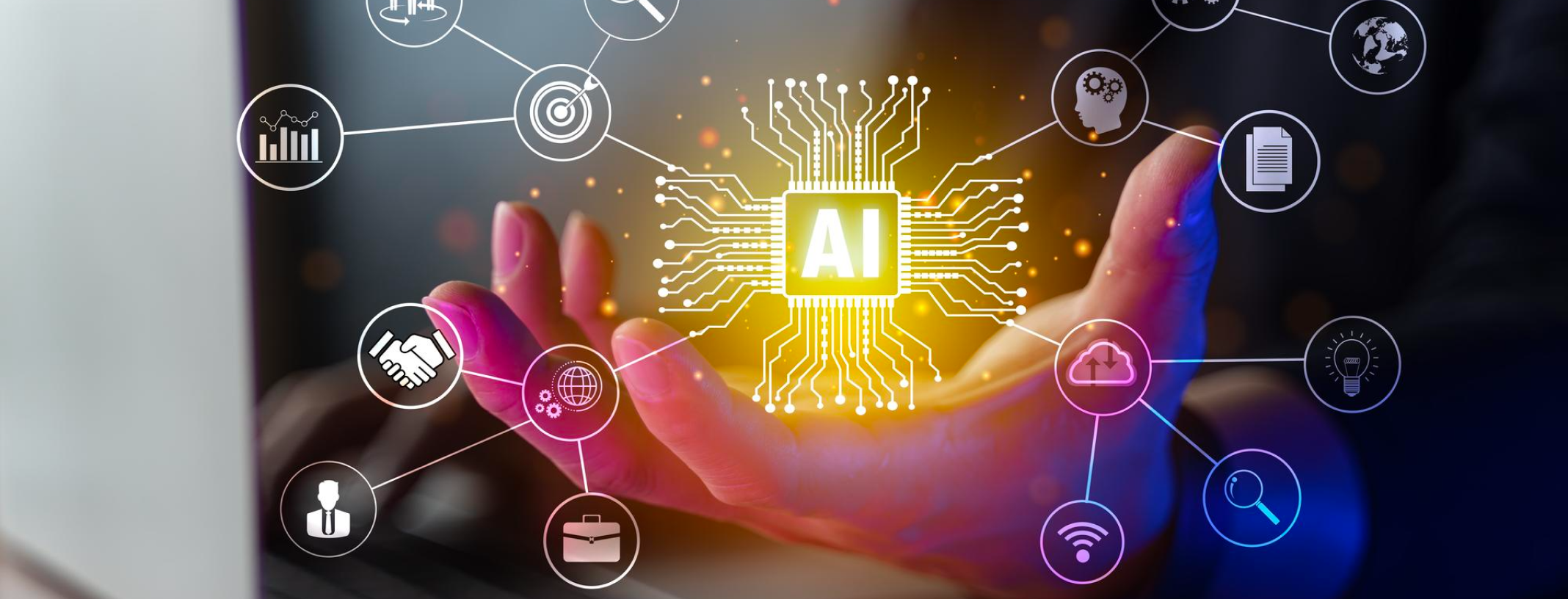

Artificial Intelligence

AI is transforming various aspects of fintech, from fraud detection to customer service. Machine learning algorithms analyze vast amounts of data, providing valuable insights for decision-making.

Big Data Analytics

Fintech organizations can obtain significant insights into risk management, market trends, and customer behavior by processing and analyzing large datasets.

Cloud Computing

Cloud technology enhances scalability and accessibility, enabling Fintech Software Companies to offer services on a global scale. It also facilitates secure storage and processing of sensitive financial data.

Challenges in Fintech Software Development

Regulatory Compliance

Fintech companies must navigate complex regulatory landscapes to ensure legal compliance. Understanding and adhering to regulations is crucial for avoiding legal issues and building trust with users.

Security Concerns

Given the sensitivity of financial data, security is a top priority. Fintech software developers must implement robust security measures to protect against cyber threats and ensure data privacy.

Integration Complexity

Integrating with existing financial systems and emerging technologies can be complex. Fintech developers need to design software with the flexibility to integrate seamlessly while maintaining stability.

Future Trends in Fintech Software

Decentralized Finance (DeFi)

DeFi platforms leverage blockchain to provide decentralized alternatives to traditional financial services. These include lending, borrowing, and trading without relying on traditional banks.

Open Banking

Open banking initiatives promote collaboration between financial institutions and fintech startups, allowing for the secure sharing of financial data. This fosters innovation and enhances the overall customer experience.

Contactless Payments

The rise of contactless payments, driven by technologies like NFC, is reshaping how we make transactions. Fintech software will continue to play a crucial role in advancing secure and convenient payment methods.

Personalized Financial Services

AI-driven personalization is becoming increasingly prevalent in fintech. Tailoring financial services to individual preferences and needs enhances user satisfaction and engagement.

Success Stories in Fintech

PayPal

Founded in 1998, PayPal revolutionized online payments. Its secure and user-friendly platform transformed how people transfer money, making online transactions more accessible.

Square

Square, launched in 2009, introduced a mobile point-of-sale system, enabling small businesses to accept card payments easily. Its innovative approach democratized payment processing for entrepreneurs.

Robinhood

Robinhood disrupted the stock trading industry by introducing commission-free trades through its user-friendly mobile app. This approach attracted a new generation of investors to the financial markets.

Best Healthcare Software Development Company

Fintech Software and Financial Inclusion

Bridging the Gap

Fintech has the potential to bridge the financial inclusion gap by offering services to unbanked populations. Mobile banking and digital wallets provide avenues for individuals without traditional banking access.

Reaching the Unbanked

In developing regions, where traditional banking infrastructure is limited, fintech software opens doors to financial services. Mobile money solutions empower individuals by providing access to banking services through their smartphones.

Impact of Fintech on Traditional Banking

Disruption and Innovation

Fintech’s disruptive nature challenges traditional banking models, prompting established institutions to innovate. This competition fosters a dynamic financial ecosystem that benefits consumers with improved services and options.

Collaboration Opportunities

Rather than outright competition, there are opportunities for collaboration between fintech startups and traditional banks. Partnerships can lead to the integration of innovative solutions within established financial systems.

Considerations for Fintech Startups

Market Analysis

Thoroughly understanding the target market is essential for fintech startups. Identifying specific needs and preferences enables startups to tailor their solutions to meet user expectations.

User-Centric Approach

Putting the user at the center of the development process ensures that fintech solutions align with user expectations. Regular feedback loops and usability testing contribute to user satisfaction.

Scalability

Building scalable fintech solutions is crucial for accommodating growth. Anticipating increased user demand and market expansion ensures that the software remains effective in the long run.

Future Career Opportunities in Fintech

Software Developers

Fintech relies on skilled software developers to create innovative and secure solutions. Developers proficient in languages like Python, Java, and JavaScript are in high demand. Anques Technolab is a software development company specializing in Fintech Development Company, based out of USA, India. They boast a team of experienced Hire Fintech Developers with expertise in crafting tech-driven solutions for the financial technology sector.

Top Grocery App Development Company

Data Analysts

Data analysts play a crucial role in extracting insights from vast datasets. Their analyses inform decision-making processes and contribute to the continuous improvement of fintech services.

Cybersecurity Experts

Given the sensitivity of financial data, cybersecurity experts are vital for safeguarding fintech software. Their expertise ensures that user information remains secure from potential threats.

Conclusion

In conclusion, the world of fintech software development is dynamic and full of opportunities. Fintech is changing how we interact with financial services by utilizing innovative technologies and tackling problems. Navigating the changing fintech world requires staying up to date with these trends and considerations, whether you’re a customer, developer, or entrepreneur.

Frequently Asked Questions (FAQs)

What is Fintech?

Fintech, short for financial technology, refers to the use of technology to enhance and automate financial services.

How does Fintech impact traditional banking?

Fintech disrupts traditional banking models, prompting innovation and competition, ultimately benefiting consumers with improved services.

What are the key technologies driving Fintech innovation?

Blockchain, artificial intelligence, big data analytics, and cloud computing are key technologies driving innovation in the fintech sector.

How can Fintech contribute to financial inclusion?

Fintech provides solutions to reach unbanked populations through mobile banking, digital wallets, and other accessible financial services.

What career opportunities exist in Fintech?

Career opportunities in fintech include roles such as software developers, data analysts, and cybersecurity experts.